Wealth and income have been extremely unequally distributed for over 100 years (see World Inequality Report 2022): The world's richest 10% own 75% of the world's total wealth (on average 550,000 euros per person), while the poorest 50% even own 2% of the total assets (on average 2,900 euros per person). The 1% richest even own 38% of the total assets (on average 2.8 million euros per person). The 2,640 billionaires worldwide in 2023 according to the Forbes Billionaires List, together held approximately $12.2 trillion in assets. They owned more than twice as much as the poorer half of the world's population (about 3.5 billion people) put together.

These extremely large fortunes and incomes of individuals (millionaires) cannot have been earned through merit and must be returned to those who have little.

In 2021 there was private wealth of US$ 473 trillion worldwide (see CS 2022). The world's approximately 63 million millionaires (about 1% of the world's population) own US$ 235 trillion. In 2026, Elon Musk was the richest person in the world with a fortune of $700 billion.

If you dispossess all millionaires down to US$ 1 million and distribute the money equally to the 3.5 billion adult poor (those with less than US$2,700 in assets), each person will receive a one-off payment of US$ 49,100. Alternatively, if you impose a wealth tax on the millionaires at an appropriate rate of, for example, 6.5% (6.5% is the expected annual return on assets including inflation, see WIR 2022, page 90) and pay out the money to the 3.5 billion poor, each person would receive 4,360 US dollars per year. Over the lifetime of a person (currently around 70 years on average), this is US$ 305,000 (including compound interest effects of e.g. 2% per year, this sum is US$ 667,000), which the millionaires withhold/steal from every person. In most countries this sum is huge. Each person can then, for example, buy an apartment with water and electricity and has escaped poverty.

In Germany, private wealth amounted to 20.2 trillion euros in 2024 (see Bach et.al. 2026, page 65). The millionaires (approximately 1.6 million people) own about 45% of this wealth (see Bach et al. 2026, page 69, share of the top 2.3% wealth), i.e., approximately 9.09 trillion euros. This wealth of millionaires increases annually by approximately 7% (the return on wealth of millionaires including inflation, see Bundesbank 2022, page 34), i.e., by approximately 636 billion euros per year, with a strong upward trend. If the millionaires were expropriated down to 1 million euros and the money distributed equally among the 35 million adults with very low net worth (those with assets of less than 4,000 euros), each person would receive a one-time payment of 214,000 euros. Alternatively, if one were to tax millionaires with a wealth tax/levy equal to their annual return on wealth of 636 billion euros and distribute this money to the 35 million low-income adults, each person would receive 18,170 euros per year. Over a person's lifetime (currently around 80 years on average), this amounts to 1,453,000 euros (including compound interest effects of, for example, 2% per year, this sum would reach 3,591,000 euros in 80 years), which the multimillionaires and billionaires are thus withholding/stealing from every individual.

The reintroduction of wealth taxes in Germany is being pursued consistently only by the Left Party. The CDU/CSU, AfD, and FDP completely reject wealth taxes and levies, and for the SPD and the Greens, they are so unimportant (and low) that they have played no role in their participation in government so far and likely will not in the future. Motions by the Left Party in the Bundestag (on January 19, 2010, and February 10, 2026, for the reintroduction of a wealth tax, and on November 8, 2022, for the introduction of a wealth levy) were/are being rejected by all other parliamentary groups with flimsy excuses.

The parties' proposals for 2026 include the following tax rates for wealth taxes:

| Wealth tax | ||

|---|---|---|

| Party | Tax rates | Tax revenues |

| CDU/CSU | not planned | 0 euros/year |

| AfD | not planned | 0 euros/year |

| FDP | not planned | 0 euros/year |

| SPD | from 2 million euros: 1% from 1 billion euros: 2% | approx. 40 billion euros/year |

| Grüne | from 2 million euros: 1 % | approx. 35 billion euros/year |

| Die Linke | from 1 million euros: 1 % from 50 million euros: 5 % from 1 billion euros: 12 % | approx. 147 billion euros/year (see Bach et.al. 2026, Die Linke 2026) |

| Capital levy | ||

|---|---|---|

| Party | Tax rates | Tax revenues |

| CDU/CSU | not planned | 0 euros/year |

| AfD | not planned | 0 euros/year |

| FDP | not planned | 0 euros/year |

| SPD | unclear | small amount |

| Grüne | unclear | small amount |

| Die Linke | from 2 million euros: 0,5 % from 10 million euros: 1 % from 100 million euros: 1,5 % | approx. 54 billion euros/year (calculated from Bach et.al. 2026) |

As you can see, only the Left's wealth tax concept can seriously serve as the basis for a sensible tax proposal. However, in order for the enormous inequality in Germany to actually be reduced and for all of us – 98% of the population – to noticeably benefit, we must fully capture at least the 7% return on wealth of millionaires through appropriately tiered tax rates (currently around 636 billion euros/year, see above). It is essential to ensure, from a constitutional perspective, that the wealth tax does not constitute a tax on assets (i.e., no tax rates above 4%) and instead provides for higher tax rates in the capital levy. Unlike wealth tax, the wealth levy is limited in time (e.g., to 30 years) and serves to address specific crises, in particular the inequality, poverty and low-wage crises, as well as the restoration of infrastructure and social housing in Germany.

At least half of the revenue from wealth taxex - currently approximately 9,000 euros/year, see above - must be paid directly and tax-free to the 50% of the population with little wealth. This will directly redistribute the wealth of multimillionaires and billionaires to the less wealthy, enabling them to escape poverty and the low-wage sector.

This results in the following proposal for wealth taxes in Germany:

| Wealth tax | ||

|---|---|---|

| Tax rate | Tax revenue | Tax expenditure |

| from 1 million euros: 2 % from 50 million euros: 4 % | 195 billion euros/year (calculated from Bach et.al. 2026) | for states and municipalities |

| Capital levy | ||

|---|---|---|

| Tax rate | Tax revenue | Tax expenditure |

| from 1 Mio euros: 2 % from 50 million euros: 12 % from 1 billion euros: 20 % | 442 billion euros/year (calculated from Bach et.al. 2026) | Direct payment: 9,000 Euros/year to each low-income individual; 127 billion euros/year for infrastructure restoration etc. |

To ensure that multimillionaires and billionaires actually pay their taxes, anticipated tax avoidance strategies, such as withholding investment, relocating residence abroad, and exploiting tax loopholes, must be prevented through a significant tightening and revision of relevant laws and the establishment of effective administrative structures to enforce these laws. Furthermore - and this is in the interest of all states-tax harmonization - agreements must be concluded with other countries.

In 2021, global income (after social security contributions and before taxes, full-time and part-time employees) was around 86 trillion euros (see WIR 2022). The low-income (half of the adult population) have a share of 8.5% of global income, or 7.3 trillion euros. This corresponds to a monthly salary of 230 euros per person. The highest earners (10% of the adult population) have a 52% share of global income, i.e. 44.7 trillion euros. This corresponds to a monthly salary of 7,300 euros per person. The top earners (1% of the adult population) even have a monthly wage of 26,800 euros per person.

The middle income (equal distribution of total income) is 1,375 euros per month.

These extreme and unfair income inequalities must be eliminated. One possibility is to limit income linearly between a minimum and maximum income. For example, if you set the minimum income at 80% of middle income and the maximum income at 120% of middle income, the minimum income would be 1,100 euros per month and the maximum income would be 1,650 euros per month. The low-wage earners could thus escape their poverty.

In Germany (see WIR 2022), the low-income (half of the adult population) have a share of 19% of all income. This corresponds to a monthly salary of 1,270 euros per person. The highest earners (10% of the adult population) have a 37% share of all income. This corresponds to a monthly salary of 12,300 euros per person. The top earners (1% of the adult population) even have a monthly wage of 42,500 euros per person.

80% of the lower-income adult population derives their income mainly (over 90%) from wage labor, while the top 1% with the highest income derives their income mainly (over 70%) from profit and capital income (see IncomeWiki 2023)

The middle income (equal distribution of total income) is 3,325 euros per month.

If you set the minimum income at 80% of middle income and the maximum income at 120% of middle income, the minimum income would be 2,660 euros per month and the maximum income would be 3,990 euros per month. The low-wage sector would thus be dissolved.

Another means of ensuring a minimum income is a basic income (see www.grundeinkommen.de for the various models). Depending on the model, it provides a minimum income of approximately 1,200-1,500 euros per month. The cost is estimated at approximately 1 trillion euros, which will be financed through various taxes (such as increases in income tax, value-added tax, and other taxes).

Thomas Piketty is the world's leading scientist in the field of inequality research. He became known worldwide primarily for his work Capital in the 21st century (circulation over 2.5 million ., translated into 40 languages). Together with more than 100 scientists, he has been building up an extensive database on global inequality since 2011, the World Inequality Database. The World Inequality Report 2022 was recently derived from this.

Piketty has also studied inequality historically: It has existed worldwide for over 100 years: 50% of people own almost nothing (just 2% of global wealth) meanwhile the richest 1% own more than 30% (see WIR 2022, p. 93).

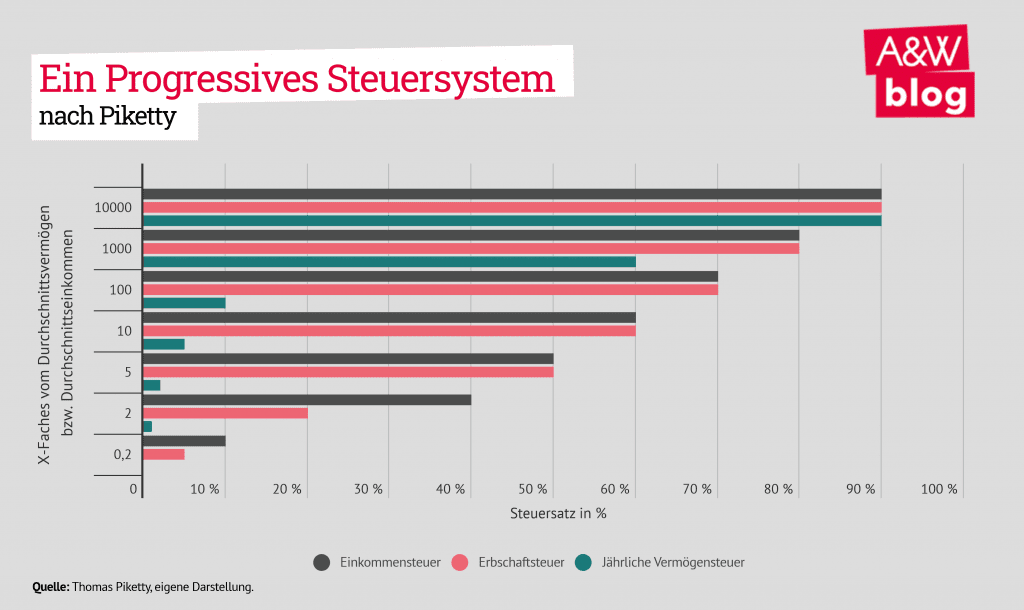

Piketty proposes a progressive wealth, inheritance and income tax as the main instrument to overcome inequality:

Image taken from https://awblog.at/piketty-2-0-ideen-verteilungsgerechtigkeit/

So if someone owns 5 times the average wealth, their inheritance tax is 50% and their annual wealth tax is 2% of their wealth.

Piketty proposes to distribute the revenue from these taxes to the 50% who have few:

"The closest solution (...) would be an inheritance system whereby the entire population could enjoy a minimal inheritance. Such a minimal inheritance could be around (...) 60% of the average wealth per adult (i.e. 120,000 euros with an average of 200,000 euros as is currently the case in France) and be paid out to everyone at the age of 25 (from Piketty 2022, p. 176)."

Piketty proposes a welfare state based on the principles of democratic, self-governing and decentralized socialism to overcome capitalist power relations:

In addition to these demands by Piketty, there are further conclusions and implementation options for the democratization of companies:

Companies are currently predominantly owned by the richest 10%. Through an equal redistribution of wealth and income (see above), ownership of companies is automatically distributed more evenly. Previously, the richest 10% were in control of the companies, but after redistribution, all sections of the population are equal. Furthermore, after a redistribution, the profits of the companies are more evenly distributed to everyone.

Everyone works according to their skills, interests and needs. He chooses a job accordingly and applies for it in a company. If there are too many applicants, a random draw will be carried out. So everyone gets the same chance of a job. If you want, you can apply for several jobs. For example, someone works 5 hours a week in elderly care and 15 hours in web design. You can change jobs at any time.

Work tasks are carried out in a company in a democratic and professional manner. The project manager and the sub-project manager for a work task are democratically elected by the employees involved in the work task. These decide on the work organization within the work task. They can be re-elected at any time at the request of an employee. In addition, all employees work together as equals. In the work task, the central objective is not profit, but the technical solution of the task with the help of the competence of all employees.

Work is divided into more pleasant and more unpleasant work in a points system by means of regular surveys of everyone. In addition, work for which there are too few is valued higher and work for which there are too many is valued lower. This rating is then mapped to the level of income.

It is now a matter of politically implementing Piketty's groundbreaking results and proposals.